For Tax Traders’ director Josh Taylor, the road to success has been far from smooth. Having sold the family home to start his business almost five years ago, Tax Traders is now one of the fastest growing companies in New Zealand, having been named on this year’s Deloitte Fast50 Index.

“When we first started, some of our developments were delayed, such as our IT platform,” recalls Taylor. “The platform was only delayed by three months, but it delayed our revenue by twelve months. It put a lot of pressure on us so it got pretty tight.”

“But these are the classic stories of early businesses, and we managed to hold our nerve until things turned around,” says Taylor.

What sustained Tax Traders in the early days was a deep conviction that a more innovative approach to tax pooling could reduce the pain of provisional tax for all New Zealand businesses. For business owners, provisional tax has always been a tricky one. While expected to pay based on profit projections and at arbitrary dates, businesses still get stung by Inland Revenue with interest and penalties if they get it wrong. And while Inland Revenue has been focused on ways to reduce interest costs, little has been done to address the cash flow issues surrounding tax payments.

That’s where tax pooling comes in. More than a decade since it was introduced, tax pooling is still a little known practice among the wider public. But it’s a way for companies and individuals to pay tax when it suits them, not when it suits Inland Revenue.

“Tax Traders provides people with a less costly, more flexible way of meeting their tax obligations,” explains Taylor. “Rather than having Inland Revenue refund old tax payments and receive new ones, tax pooling enables payments to be traded between taxpayers so an existing payment can be applied elsewhere.”

Five years on from selling the family home, Taylor’s conviction has been validated. Tax Traders serves a number of the NZX20 and thousands of private businesses nationwide.

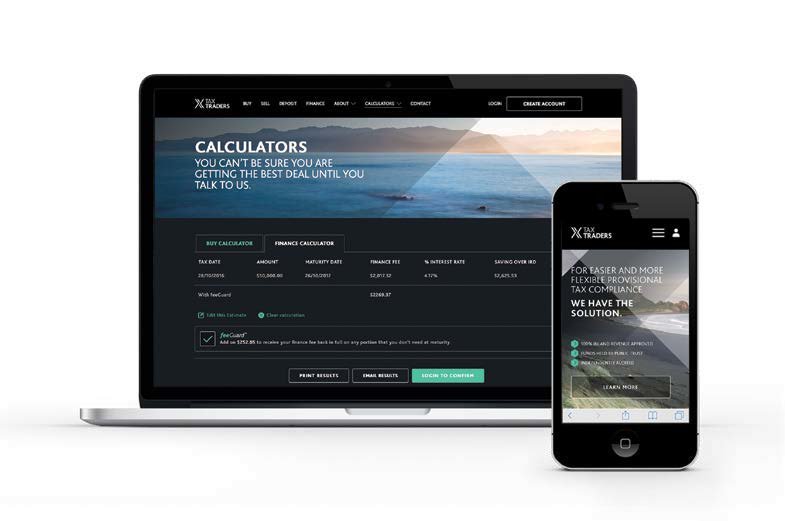

With things like no minimum limits, flexible payment dates, automated deposit processes, and protection from financing too much, Tax Traders is leading the way in innovative solutions to tax management. But Taylor insists that the greatest innovation Tax Traders has introduced to the industry is its relentless commitment to customer service.

“Until we started, client engagement was limited because the industry was so focused on systems,” says Taylor. “But the feedback we received from users was that whilst they enjoyed aspects of the automation and online experience they wanted this coupled with more contact with the people behind the company so they knew they weren’t dealing with just a black box.”

“So, we have been relentless in focusing on our clients and have always treated them as unique individuals with different requirements. We really take the time to get to know them and love it when they ring us with special requests or last minute problems that we can solve. We want to make things transparent and make people feel more engaged. It’s a type of soft revolution of the tax industry. Living in this hyper speed world, people like to be treated like people, and not just on a transactional basis.”

In addition to this personal approach, Tax Traders also understands that for businesses, time and cost are pivotal. “From a business perspective, we’re all about helping them manage the cash flow timing of their tax payments,” says Taylor. “We allow taxpayers to defer their tax payments and preserve working capital, without incurring interest and penalties from Inland Revenue.”

Looking ahead Taylor remains positive about New Zealand’s tax trading future, “We hope our way of doing things will see more companies take the plunge and begin tax pooling”.