It’s easy to imagine what the world might look like in ten or even fifty years time, but what will New Zealand’s biggest sectors look like in 500 years’ time? Thanks to our friends at Tech Futures Lab, we went out to some of New Zealand’s most inspiring business leaders and asked them to imagine a far, far away future. Here’s Simplicity founder Sam Stubbs on the future of money.

Picking what the world of money will look like in 500 years’ time is like someone in 1519 trying to imagine an Eftpos machine. It’s very tough. But one thing I’m confident there will still be in 2519 is money.

That’s because, as a medium of exchange, it’s worked for thousands of years. It doesn’t matter what it looks like, and money has looked like very different things in history. In the last 500 years, people could exchange things via gold, silver, precious stones, big round stones with holes in the middle, diamonds, leather, herbs, spices, coins, stamps, paper notes, plastic cards, keypads and apps. We always need a way of exchanging goods and services via a trusted method of exchange. The alternative – bartering – sounds tempting, but shifting goods and services around until they find the person who really wants them will always be just too cumbersome.

So, what will money look like? I’m betting it’ll actually look like nothing. Rather, it’ll be a thought, a mental transaction between two people or one person and an automated ledger. Let’s call that a modern day ‘bank’, without almost no fees. It’ll come to this because the brain is a biological computer. There may well be a layer of spirituality that is unfathomable, but basic thoughts will soon be understandable and trackable. Most people will want to keep most thoughts to themselves (imagine the trouble if you didn’t!) but where you wanted your thoughts to be understood by others, I see little impediment to that. So, anyone who wants to to think about paying for something, or depositing or borrowing money, an imbedded sensor in the brain will pick that up and transmit it to an exchange or directly to another person.

We have seen an inkling of this with thought controlled prosthetics and Amazon shops allowing for people to walk out of stores with goods without paying in the traditional sense, by scanning and paying automatically.

Why do it this way? Because it’s simple efficiency. Credit cards, Eftpos and direct debits all are cumbersome, lack transparency and provide opportunity for extraction of fees and interest. By being able to ’think’ a payment, there will be little opportunity for the middle person to extract a fee for nothing.

This will also allow for instant payments for everything, such as a by-the-minute salary and tax payments, and hour-by-hour rent payments. And it’s likely that much less will be bought and much more rented. We’ve seen this recently with car sharing, and it’s likely that will happen more and more with transport, accommodation, clothing and digital everything.

And what of banking? It won’t exist in the form we see it now. That’s because fundamentally, banks are market places, where depositors put their money (and get interest), for the bank to then on lend it to people who come to them to borrow money (and pay interest). It’s fundamentally a very opaque marketplace and you need a guide dog in the form of bankers to navigate around. To see how inefficient it currently is, a depositor gets (say) two percent on deposit, only for the bank to on lend it at (say) four percent. So the person supplying the actual money to lend gets two percent, while the bank arranging and servicing the loan gets two percent, too. In 500 years, the ‘in-brain’ intermediary between depositor and borrowed – which will be the closest thing to a bank there is – will get a tiny fraction of this.

The marketplace idea of future finance could be wonderfully efficient. If you want to deposit money, you will be given many choices by just thinking about them, and will likely deposit it in many places. And if you need to borrow money, it will come, almost instantly, from thousands of lenders keen to spread the risk. So depositors and lenders will, in a sense, mind meld to a transaction. In a very clunky way you can see that happening now with fractional lending, e.g. Harmoney and Squirrel. And transactions will be thoughts, instant, free and seamless.

And there will be one currency. Brexit aside, the Euro is a taste of the future. If you can think money anywhere at the speed of light, it’s hard to see why you would want multiple, cumbersome currencies. In 500 years, we will almost certainly be an interplanetary species, and possibly an interstellar one. That will be a problem for money transfer, as we will still be restrained by the speed of light. So different mind-money exchanges will exist in different solar systems. And that will open the door for the same rip off foreign exchange fees we still pay, it’s just that they’ll be interstellar ones this time. Much will change, but some things won’t.

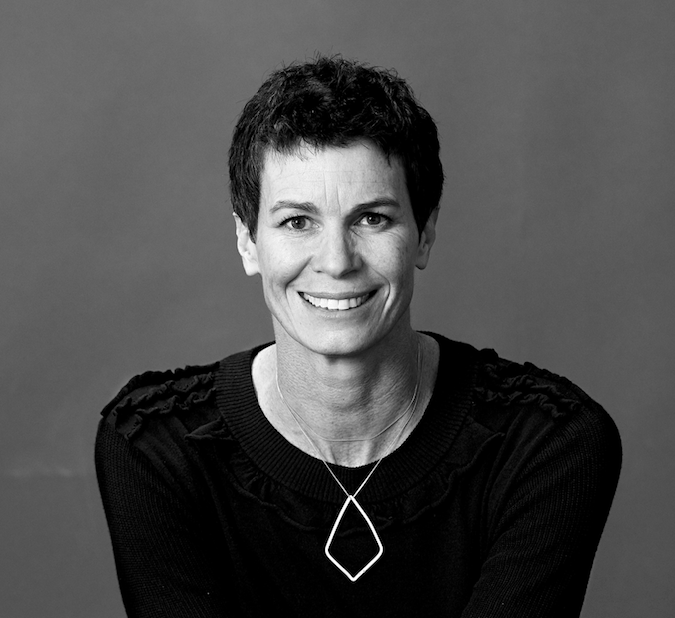

About the writer

Sam Stubbs is the founder and managing director of Simplicity. He was most recently the CEO Of Tower Investments, a KiwiSaver default provider. Before that, he was managing director of Hanover Group and spend 10 years working for Goldman Sachs in London and Hong Kong.

About Tech Futures Lab

Are you looking to be more intentional about your life, career and impact on the world in the context of massive technological, organisational, social and environmental change? The Postgraduate Certificate in Human Potential for the Digital Economy, new from Tech Futures Lab, is designed to help you do exactly that. Registrations now open for our February 2020 intake. Find out more at its website or call +64 (9) 522 2858.