Slice: Introducing the new start-up reducing barriers towards home ownership

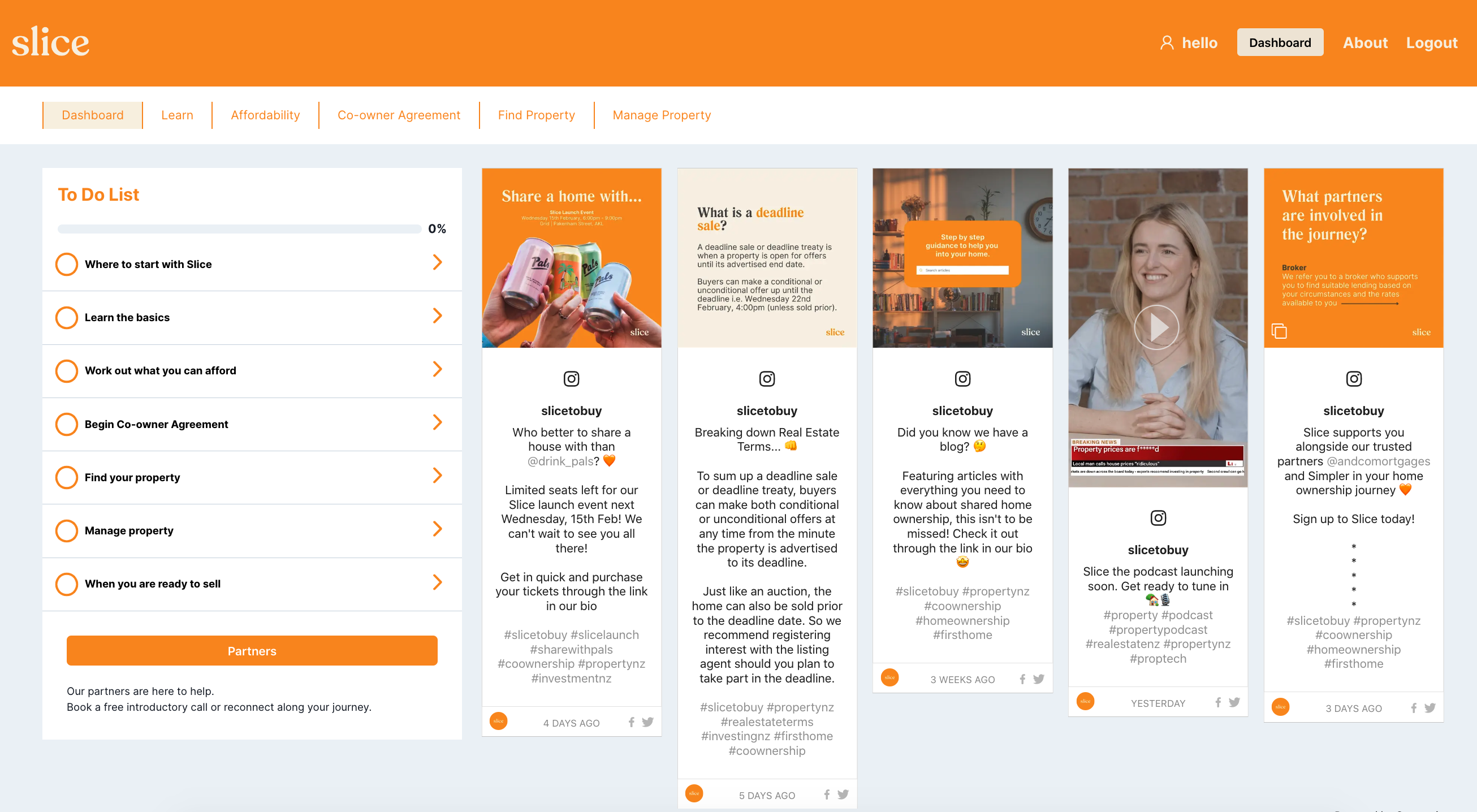

New tech start-up, Slice, is an innovative platform working to make the housing market simpler and more accessible.

Having navigated the confusing market herself, Founder Amy Stevens, created Slice as an end-to-end tech platform that tackles the barriers of home ownership in New Zealand through education, step-by-step guidance, and automated software.

While homeownership is not on the cards for 40 percent of Kiwis, those who do enter the market often find it confusing.

“Slice exists to reduce barriers to home ownership through education and the creation of alternative and more accessible pathways,” says Stevens.

“We are committed to revolutionising the property sector as we strive to create a world where everyone has the opportunity to own a home and secure their financial future.”

Stevens built Slice after struggling to buy her first home and wanted the process to be easier for others.

Using her experience in finance and law and with the knowledge she gained through purchasing her first home, she developed the platform.

Read more: Start-up fintech company raises $35 million, triples in growth

Through Slice, Kiwis are introduced to new pathways and tools to explore their options within the New Zealand housing market.

Stevens says Slice was born to represent stability, security and belonging by providing alternative methods of getting on the property ladder such as shared home ownership which has been a new and popular concept.

The start-up platform aims to simplify the overwhelming and stressful house buying process whilst also empowering customers through education on the home buying journey.

Supported by the likes of popular podcaster Simran Kaur and entrepreneur Marissa Fong, Stevens is confident the platform is a way to address the housing affordability in New Zealand.

“It’s great to see Kiwi ingenuity combined with tech to solve a most confronting problem that Kiwis are facing,” says Kaur.

“It fills a gap that is so desperately needed in today’s climate,” adds Fong.

The platform is available from February 15 and enables customers to do the following: work out what they can afford, secure finance, understand investment options through low deposit, shared ownership, rent-to-own, generate accurate legal agreements reflective of specific circumstances, find a property and complete due diligence and track contributions and make changes to their equity over time.