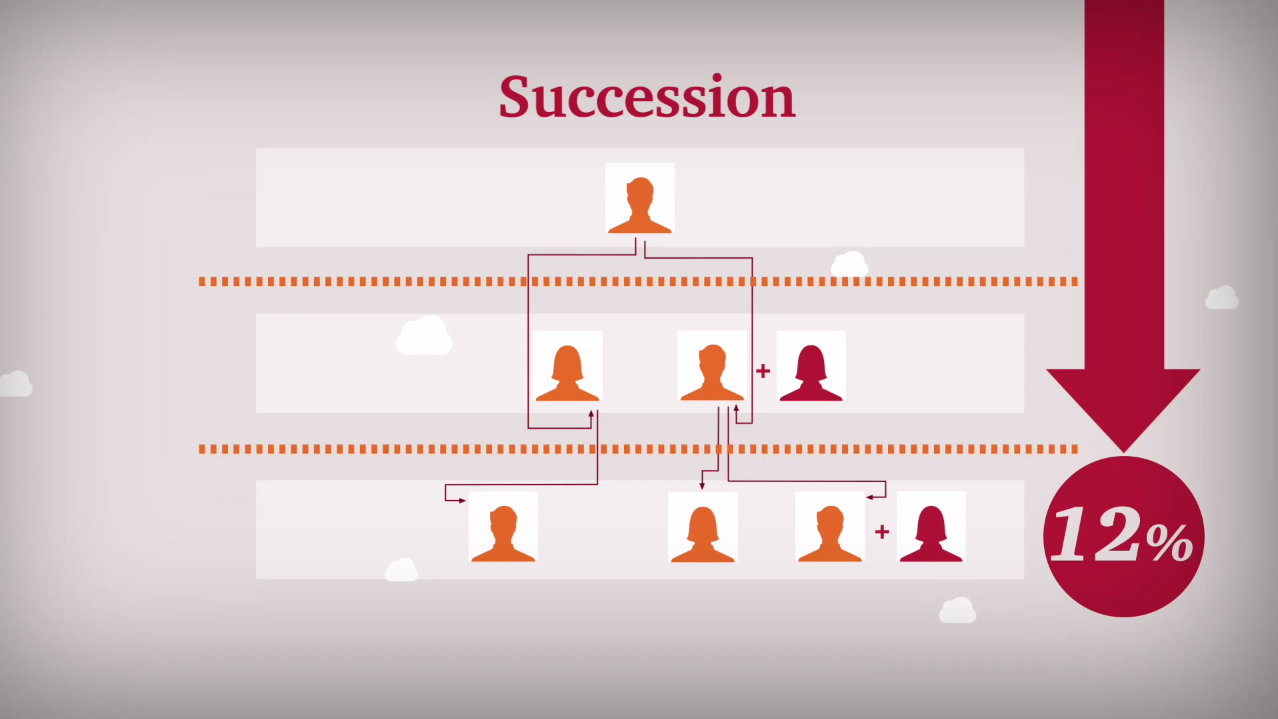

What is mind numbing is that only 17% of business owners say they have a robust and documented succession process in place, according to a recent just released by PwC family business survey. This is despite family businesses’ stated ambition to wanting to grow their business over the next 5 years.

Poor succession planning is not just a Kiwi problem. In the US, the chances of family-owned firms surviving beyond one generation is low. According to The Alternative Board in the US, the majority of owners believe their family-run business won’t remain in the family into the generation.

This laid back attitude to succession planning is however consistent with the global story which shows a low legacy rate of family-owned concerns. Only 70% of family-owned businesses, last just one generation, according to the Cox Family Enterprise Centre.

About 80% of the world’s businesses are family owned. Among the world’s largest companies are family-owned—News Corp, Samsung, Tata Group, and Walmart. (Source: Cox Family Enterprise Center)

The New Zealand findings point to businesses being slow to adopt strategic succession planning.

“A plan that is not set out in writing is not a plan; it’s just an idea. This is an issue family firms must address because without it, their whole enterprise is at stake. This red flag is creating unnecessary exposure for families and their businesses which should not be ignored. As one of the interviewees said,” PwC’s Private Business Market Leader Robbie Gimblett says in releasing the firm’s global survey on Thursday.

“Just over half of respondents have a shareholder agreement and procedures in place for measuring and appraising performance, meaning that the other half don’t, and even more than half surveyed have no procedures in place in the event of incapacity or death of a family member or conflict resolution mechanisms. We’re encouraging family businesses to address these risks and to formalise planning to protect their businesses for the future,” says Gimblett.

And when family businesses fail, they generally fail for “family reasons”, he says, quoting a client’s observation.

Conflict, what conflict?

The survey also shows that 9% of New Zealand businesses surveyed expect “family conflict” to be a challenge (over the next five years) compared to 11% for the rest of the world.

Businesses also do not seem to place creating employment for other family members as an important area of business planning. Only 0.6% of Kiwi respondents list it as an area of importance (0.7% for rest of world).

A total of 83% of those surveyed feel family businesses do all they can to retain staff and have stronger culture/values while 75% say family businesses have a strong sense of responsibility to support employment. Some 68% feel family businesses support community initiatives.

Blood ties are strong

Among family-owned businesses, 100% have family working as senior executives within the company, 42% have family who own shares in the firm but don’t work there, and 51% have family in the firm but not in senior roles.

New Zealand’s family-owned firms are also shy to expand beyond their comfort zone. This year’s survey shows that 25% of New Zealand family business sales are international and this is set to rise to 34% in 5 years’ time.

But none of the New Zealand family businesses surveyed expect to be exporting to a significantly larger number of countries than they do now – they tend to stick to neighbouring countries or those with the same language and similar culture.

PwC’s family business survey 2014

To grow beyond, family businesses would need to have a new talent pool and the research suggests these companies will be missing out on new sources of growth unless they bridge the talent gap.

Gimblett adds Kiwi companies can’t rely on organic growth like those in Asia and the realisation is hitting home. “We’re seeing this awareness coming through in terms of their priorities for the next five years and ‘heads’ are winning over ‘hearts’, which has been traditionally harder for family businesses to do.”

Famous family feuds

News Corp’s Murdoch family: Prodigal son, Lachlan Murdoch, finally returned to the family business after patriarch Rupert failed to lure his son into the business. Lachlan stepped out of the family business while former stepmom Wendi Deng was in the scene. With Wendi now out of the picture, Lachlan is happy to be back in the family firm. Read story here

Casino king Stanley Ho: At stake is Macau casino boss Stanley’s sprawling empire said to be worth over US$3 billion. He and his family members have been embroiled in a messy battle over the division of his wealth. What’s complicated is his brood of 17 children from four different women, including one who died in 2004. Read Wall Street Journal’s article here

Ambanis of India: India’s richest man Mukesh Ambani and his brother Anil Ambani have been in a bitter feud ever since the death of their father in 2002. The late Ambani did not leave behind a will. Story here

Our own NZ story: According to the Herald on Sunday, Maryanne Owens, the eldest daughter of late philanthropist Hugh Green, is involved in a legal stoush with family members. The Green family’s wealth is said to worth $400 million (according to the 2014 Rich List). Family patriarch Hugh Green, who built a fortune in roading, property and construction, died in 2012 aged 80 leaving an estate of $350 million

About the PwC survey

The 2014 PwC family business survey covers family companies with a sales turnover of >US$5m – >US$1bn in over 40 countries. Interviews with top executives in 2,848 companies took place between 29th April and 29th August. For reporting purposes we included responses from 2,378 respondents, including 53 from New Zealand.

The findings indicate that despite pressures around skills shortages and market conditions, family firms remain dynamic and resilient accounting for 70 – 90% of GDP globally, and are an effective barometer of the health of the economy.