Former agency leader Andy McLeish has launched a new digital savings platform called Wedge Money.

Andy makes the move into fintech after 12 years in agency land, where he was head of strategy at Colenso BBDO, and more recently, partner and the chief strategy officer at Bastion Shine.

He co-founded Wedge Money alongside his brother, Dave McLeish (pictured above), a seasoned fund manager with decades of experience managing low-risk investment portfolios. Their ambition is to return up to $1 billion in interest income annually to New Zealanders.

The platform was born out of the brothers’ desire to improve Kiwis’ financial wellbeing. A post from the OECD Statistics blog in 2021 showed that Aotearoa New Zealand has one of the lowest household savings rates in the OECD and Canstar research from last year shows that 52% of Kiwis would not have sufficient savings to cover two months without income.

According to Wedge Money, the savings gap is also being compounded by the major Australian banks, which are estimated to be short-changing New Zealand savers by around $3 billion in interest each year by offering low returns on on-call savings accounts while collecting record profits.

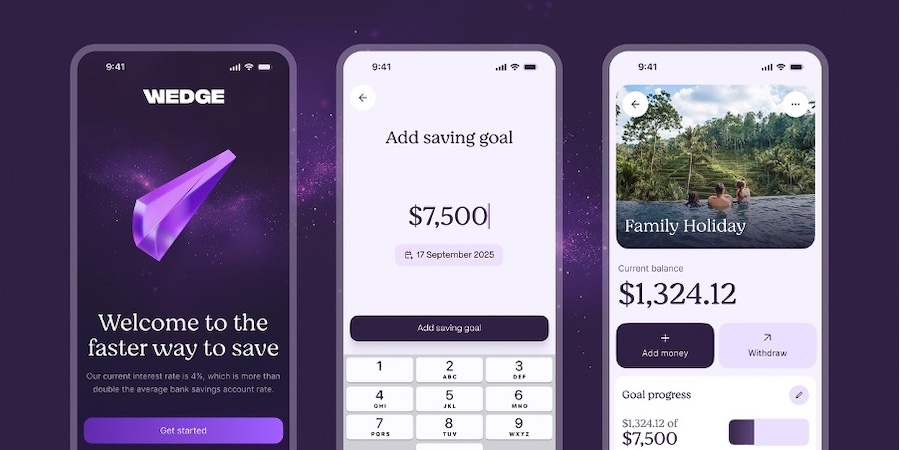

Accessible through an app and web-based savings account, Wedge hopes to deliver better outcomes for Kiwi savers.

The Wedge Savings Fund blends the accessibility of a traditional on-call bank account with the higher returns typically associated with professionally managed, low-risk investment funds.

According to RBNZ, the current average unconditional savings rate with the banks is 2.04%. At launch, Wedge will offer a return of 4% annually.

Improving financial wellbeing of everyday Kiwis

Dave says that collectively, New Zealanders miss out on billions of dollars every year due to a lack of viable savings alternatives on the market.

“While there’s been a wave of innovation in the savings sector internationally, with money managers providing smart, flexible alternatives to traditional bank offerings, it hasn’t hit New Zealand’s shores yet. But we’re proud to be changing that with Wedge.

“We’ve created the Wedge Savings Fund as an option for people who want to maximise their savings, by delivering a consistently competitive savings rate with on-call flexibility.”

Smart saving made simple and safe

The Wedge Savings Fund offers:

- A set rate of return that outpaces traditional on-call bank accounts

- Customers ready access to their funds

- An account backed by high-quality global cash and fixed income investments, typically difficult for personal savers to access

- Peace of mind, with a Fund that carries a weighted average credit rating aligned with that of the major banks

“Our goal was to develop a savings offering that combines performance, security and ease of use,” says Dave.

“For too long, access to quality financial tools has been limited to the wealthy or institutional investors. With Wedge, we’re putting those tools directly into the hands and pockets of all New Zealanders.”

A key feature of the website is the Wedge Savings Calculator. It allows users to forecast their savings growth and see a direct comparison against the returns offered by traditional bank savings accounts.

The app is now available for free download on both iOS and Android platforms.