?AA has released a suite of new online tools and information about the very taboo topic of life insurance, in partnership with UK-based DigitalWorks Worldwide.

?AA has released a suite of new online tools and information about the very taboo topic of life insurance, in partnership with UK-based DigitalWorks Worldwide.

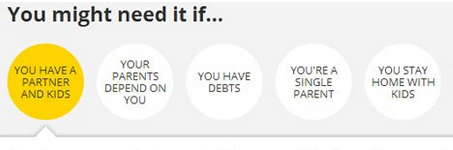

Among the tools are an insurance calculator, an interactive slider that recommends levels of cover based on different life scenarios, FAQs, a new blog and customer stories with newly-made videos.

The blog is called Insider’s Guide and AA Life marketing specialist Sabih Anwar says the topics were created according to popular Google searches about insurance.

“We wanted to be honest with people about how much insurance they might need,” says Anwar. The blog topics include ‘what is life insurance’, ‘how is life insurance paid out?’ and ‘how much insurance do I need?’

“We have worked to identify the information and tools people need to be able to answer their questions and buy direct from us,” says AA Life general manager Keith Meyrick.

“Our site now includes a cover calculator to help people work out how much they may need for their family if they died. It makes you think about your funeral expenses, debts, future living and housing costs for your family, education costs for the kids and lump sums for various reasons.

“We’ve made the application process shorter, more simple and removed the need for medical checks.”

The organisation cited a recent survey by Massey University that showed Kiwis were underinsured in the life insurance category to the tune of nearly $200 billion. Meyrick says people avoid sorting their financial affairs because they don’t understand the process.

This post originally appeared on StopPress