Tyson Foods – one of the biggest meat producers in the world – sent its principal scientist, Hultz Smith, to the Modern Agriculture Foundation’s Cultured Meat and Path to Commercialisation Conference in Israel this year to learn from the world’s top-tier cellular agricultural and tissue engineering scientists, researchers, academics and industry leaders. A proponent of cellular agriculture, Hultz even openly supports cultured meat research, viewing it as a viable substitute to current meat production and one that gives consumers a broader choice. And in late 2016 the company launched a $150 million venture fund zeroing in on the alternative protein – including cellular agriculture – space. “This fund is about broadening our exposure to innovative, new forms of protein and ways of producing food,” said Monica McGurk, Tyson executive vice president of strategy, at its launch.

“I always approach things as a sceptic – all scientists should. It’s not feasible until I’m convinced otherwise,” says Specht. “But quite frankly, I think it’s going to take off. If you’re offering people a product that’s essentially the same thing, nutritionally very similar, taste very similar and the price is there, why wouldn’t people buy it?”

Other Big Food behemoths are also starting to accept the inevitability of such predictions. In the past 18 months, major food companies like General Mills, Kellogg’s, Campbell Foods and Fonterra have established strategic new venture arms and funds focusing on more sustainable food solutions and alternative proteins – including cellular agriculture alternatives.

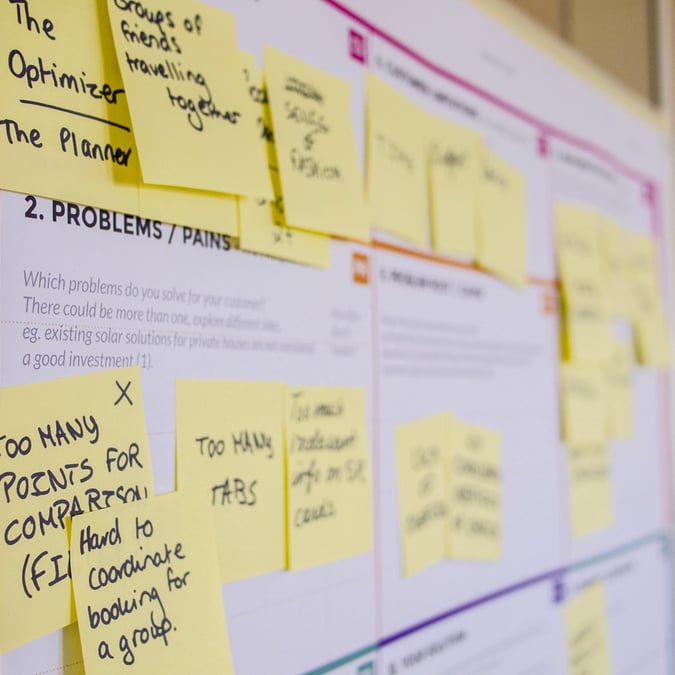

Fonterra recently launched the Fonterra Ventures Co-Lab in an effort to drive the cooperative’s ‘disruption avoidance’ strategy. The collaborative open platform provides individual entrepreneurs, small businesses or large corporates the chance to submit concepts that the dairy giant will look to potentially partner on to scale and succeed for mutual benefit. “Fonterra is fortunate to partner with some brilliant businesses in New Zealand and across the globe, and we’re looking to join forces with them in increasingly innovative ways to accelerate growth and ultimately return more value to our farmers,” says Judith Swales, chief operating officer of velocity and innovation.

Till the cows come home

While synbio’s cultured meat and milk aren’t going to replace traditional, industrialised agriculture overnight and there’s a long way to go before its production can ramp up to feed the world en masse, it is clear the train has left the station.

“When you see companies like Tyson investing in plant-based foods and when the big dogs are trying to fund smaller companies, you know a change is coming,” says Kale Walch, co founder of the Herbivorous Butcher, a company cashing in on the changing face of agriculture.

But this idealistic animal-protein-utopia does not come without its consequences, especially for agricultural producing and exporting nations like New Zealand. New Zealand’s Beef and Lamb exports alone amounted to nearly $6 billion (although that was down 12 percent on the year to November 2016). And dairy giant Fonterra’s $9.2 billion in revenue for the first half of 2017 was responsible for another sizeable chunk of the national GDP.

Demand for organic food is higher than it has been for decades as many consumers put quality before price. New Zealand stands to benefit from that shift given our strong country brand and some believe there will always be a place for naturally produced food, no matter how techno lab-based the market becomes. And some, like Mike Lee, a Silicon Valley-based consultant to NZ Beef and Lamb, argue there will be other ways for the humble Kiwi cow to benefit the country.

“If New Zealand believes that they have the best beef and lamb why wouldn’t New Zealand want to breed the prototype for these companies to multiply?” he says. “Maybe the New Zealand cow and lamb are the things that get multiplied in the labs. I think that’s the way to thrive with these innovations instead of rejecting them.”

But Valeti says all it takes is a harmless biopsy the size of a sesame seed for companies like Memphis Meats to produce enough meat for ample quarter pounders in the lab. Implying that no matter how genetically superior New Zealand’s breeding stock is, the herd sizes required to feed the world would still be minimal and potentially less profitable than Lee implies.

“Our goal is to entirely remove the animal from the meat production process,” says Valeti.

All things told, the scale of the endeavour for synthetic biology and cellular agriculture to reinvent the world’s meat and protein supply, along with the profits it has the potential to reap, is huge. And it’s a movement not to be dismissed by even the most conservative of Kiwi farmers.

“We plan to do to animal agriculture what the car did to the horse and buggy. Cultured meat will completely replace the status quo and make raising animals to eat them simply unthinkable,” says Valeti. “We know we’ve touched a chord globally.”

For now, Daisy the Cow and Farmer Brown aren’t going anywhere. But their days in the field could soon be numbered as this new and growing legion of synthetic biology and biotech companies pioneer – and continue to refine – an industry of animal-free animal products.