How Bill Phillips, a New Zealand electrician-turned-economist, built a revolutionary computing machine

Early physical modelling in economics

There is a long history of using physical models to represent, calculate, and sometimes analyse parts of an economic system.

Basic abacus and counting frames have been around for a long time. But there were also more sophisticated devices in ancient history. Ctesibius, a Greek mathematician from the second century BC, seen by some as the father of cybernetics or feedback control theory, is credited with the first automatic mechanical regulatory system, a water clock which monitored levels and adjusted flows automatically. While probably never having heard of Ctesibius, Bill Phillips was to draw much inspiration from this idea, and in his own way would apply it to economics.

In the early nineteenth century more complex calculating machines appeared, the most famous being Charles Babbage’s difference engine, which was constructed, and his analytical engine, which was not. Bab- bage was, amongst other things, one of the world’s first industrial econo- mists, but the engines were intended to assist navigational calculations and firing tables. Babbage was followed by a number of German developers of mechanical calculating machines, of increasing sophistication.1

In 1869 economist W. S. Jevons in Manchester constructed his ‘logic piano’, a wooden mechanical computer, as a computational and alge- braic logic device. A few years later Alan Marquand at Princeton University built a more sophisticated version, described as an ‘eight term logical machine’, this one electromechanical.

Some economic models were specifically developed for teaching purposes. Early academics did not have easy visual ways to present information: they not only lacked today’s computer displays, but even blackboards were not ubiquitous until the early twentieth century, and printed books were very expensive. In 1873 Alfred Marshall at Cam- bridge University commissioned a teaching machine for constructing rectangular hyperbolas. He also wrote a paper rather laboriously entitled ‘Graphic Representation by Aid of a Series of Hyperbolas of Some Economic Problems having Reference to Monopolies’. Marshall also frequently used mechanical analogies in his teaching. It helped that he was a keen handyman, inventing various labour-saving devices and gadgets.

Classical economists of the nineteenth century frequently thought in mechanical or physical terms. Francis Edgeworth used his analogy of the box in welfare economics. He also described the economic system in the context of connected lakes of various levels. Leon Walras, Vilfredo Pareto, and Enrico Barone all used computing machine meta- phors, noted some time later by Oskar Lange in The Computer and the Market.

The hydraulic analogy that would provide inspiration for Bill Phillips was a long-established one: Adam Smith in The Wealth of Nations had compared money to a great water wheel that represented the driving force for commerce. A century later famous Yale economist Irving Fisher (inventor of the rolodex) produced the first working economics machine driven by hydraulics. Fisher pointed to many parallels with hydro-mechanical systems, noting how much of the economist’s vocabulary originates from mechanics. In 1891 he designed a ‘hydrostatic machine’ as part of his doctorate thesis. Several years later this model was actually built. It was used by Fisher in class to demonstrate the deter- mination of prices in markets. His model consisted of a large tank (with a series of cisterns in it), filled with water—the cisterns, representing commodities, consumers, or producers, connected together by a series of levers that represented prices and utility.

By this time economists were frequently using hydraulic analogies. Foster and Catchings in their popular book Money published in 1923 employed a virtual model of what came to be called ‘hydraulic Keynes- ianism’. Two years later they produced another bestseller called Profit, and this went further. Chapter 23 contains a diagram of a hydraulic model of an economy. It is labelled ‘The Circuit Flow of Money’, and contains a network of reservoirs, pipes, and valves that is the closest forerunner of Bill’s ultimate design.

Five years later, as part of his doctorate degree at the University of Berlin, Soviet-American economist Wassily Leontief, the pioneer of input–output analysis, described an economic framework using the analogies of stocks, flows, and reserves of water in a river.

American economist and ex-LSE student (and incidentally the inventor of the Parker fountain pen) A. O. Dahlberg wrote on the US economy in the 1920s and 1930s, and produced a pioneering wall- chart demonstrating a model of the macroeconomy with flows based on principles of servo-mechanisms, using hydrodynamic analogies.

In the 1930s and 1940s Joseph Schumpeter (once Minister of Finance in Austria) used many mechanical and hydraulic analogies to explain his ideas on business cycles. As this list suggests, many of these early model-building economists were highly creative men with eclec- tic interests and unusual mechanical abilities in that pre-software era.

It was another such character, Kenneth Boulding, the free-thinking Anglo-American economist, activist, poet, and mystic, who may have had the most direct impact on the way that Bill Phillips was to think about hydraulic models. His 1941 textbook Economic Analysis has a description of production, consumption, stocks, and prices built around an analogy of a water tank with a diagram showing sluices flows and measurement indicators. Bill Phillips may not have known many of his modelling forebears, but he did acknowledge a debt to Boulding’s model, because he refers to it in his writings.

While Bill would likely have been unaware of the history of physical models in economics, he presumably would have been more at home with the electrical circuitry models that were becoming more prevalent post-war. British engineer Arnold Tustin used servo-mechanism the- ory to design analogue machines as models of economics dynamics. In 1954 Bill Phillips would review Tustin’s new book on this subject. Around that time American econometrician Robert H. Strotz at Northwestern University would build an electrical analogue machine to study and simulate non-linear business cycle theories. A few years later Otto Smith and R. M. Saunders at the University of California, Berkeley, were to build an electrical analogue machine to represent a business cycle model.

The gap between the disciplines of electrical engineering and eco- nomics were not as large in those days. A widely used mathematical macroeconomic textbook written in the 1950s by R. G. D. Allen, a future colleague of Bill’s at LSE, used circuit block diagrams to explain macroeconomic and business cycle theories. During his engineering studies in earlier years, Bill had confronted some of these developments.

Of course not all conceptual machines were intended to be built. Perhaps the most famous of all, Alan Turing’s Universal Machine was designed to illustrate theoretical relationships. (But a later Turing design would lead to an early industrial computer that Bill would use.) However, Bill was not primarily interested in the theory of models— his upbringing had been a world of water wheels, crystal radios, and electricity—the practical world of the engineer.

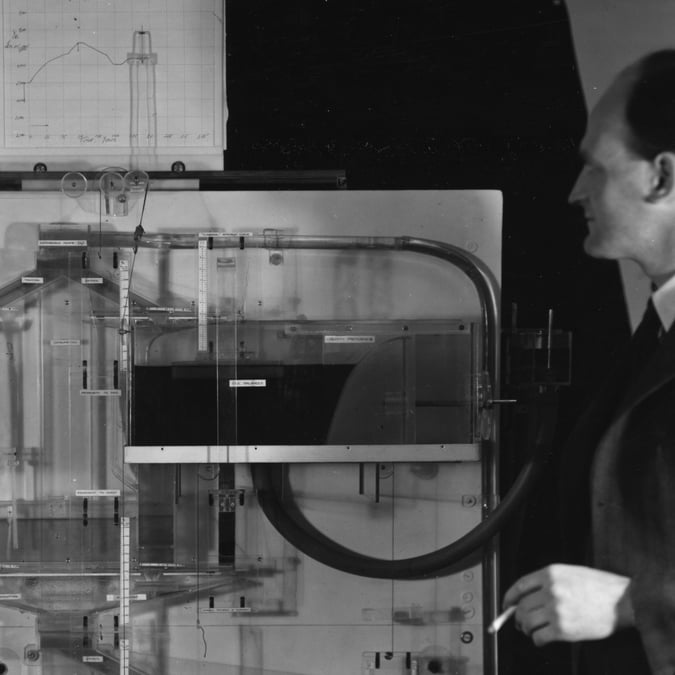

Image c/o London School of Economics, Reserve Bank of NZ

The Phillips–Newlyn machine

In 1946 there was a large group of mature ex-servicemen undergradu- ates at LSE. Amongst them was the economics student Walter Newlyn, one year ahead of Bill in his course. Despite his quiet manner Bill was to find a number of very loyal friends among his colleagues, people who would recognize and support his talents, and Newlyn was one of the first. Walter Newlyn had started work in the London Baltic Exchange and, as he wrote later in The Theory of Money, that showed him how goods and financial flows circulated in the economy. He had also had a tough war, having been evacuated from Dunkirk, before serving in the East.

The two ex-servicemen struck up a friendship and found they had much in common. They enjoyed discussing economics, and on week- ends used to go walking together on the rural paths of Surrey.

While Bill had sat in on some economics lectures during his soci- ology degree, Newlyn had enjoyed a conventional macroeconomic education at the LSE. He recalled that he gradually understood that Bill was dissatisfied with sociology, but increasingly interested in econom- ics. They talked about what they had learned from economics, and had occasional problem-solving sessions together. Later that year Newlyn graduated, and left London for a lectureship at Leeds University.

By now Bill was starting to realize that his knowledge of engineering might have something to offer to the study of economics. He wrote to Professor Richard Sayers at LSE early in 1949, saying that he had taken some of his lectures but had found them difficult to understand. Knowing something of plumbing, he had found a hydraulic model similar to the one in Boulding’s book to be a useful way to explain the concepts. He enclosed a sketch. Sayers asked graduate student Graeme Dorrance to meet this unusual student and see if he could help him.

In 1949 Walter Newlyn returned to London on a visit to LSE, and met Bill there. The latter was very excited to talk: he had just written his first economics paper, and he was keen to show it to Newlyn. It was plainly entitled: Savings and Investment, Rate of Interest and Level of Income. Newlyn’s wife Doreen writes: ‘That seminal paper of Bill’s, typed by him on an old manual typewriter, five pages of flimsy foolscap wartime paper, yellowed by age and Bill’s cigarettes, given by him to Walter, still exists’.

This paper showed that Bill was thinking as an economist about how to represent an economy, and as an engineer his focus was on the stocks and flows of both commodities and money. He worried that a trad- itional diagram could not show this properly as stocks and rates of flow are not as easily compared as, for example, distance and speed. ‘The process can however, be illustrated by a hydraulic analogy, as in K. Boulding, Economic Analysis’.

This is Bill’s first reference to a hydraulic mechanism. He illustrated the idea with a flow diagram which suggests that he may have had a working model in mind, although there is no mention of building a machine at this stage. The last part of the paper is about the rate of interest and level of income. Applying the hydraulic analogy to classical theory, Bill demonstrated that the preference for liquidity is entirely determined by flows, while applying it to Keynesian theory he could show it would be entirely determined by stocks.

One of Walter Newlyn’s contributions was to help Bill think of this system not simply as a market-equilibrating mechanism (as in Irving Fisher’s model), but as a complete macroeconomic system.

Newlyn recognized immediately from the diagram in the paper that Bill had in mind a mechanical model, using water flows as a way of demonstrating the effects of changes via a set of simultaneous equations. Newlyn was interested in this. He asked whether it might be possible to build a machine that could be used as a teaching aid. Bill replied that he probably could construct such a machine.

Newlyn thought it surprising that Bill had not used the synthesis by Oxford economist John Hicks, known as the IS-LM framework, and he concluded that Bill’s subsidiary courses in economics had not yet covered this. The Hicks framework could show how to interconnect demand and supply for money and goods. Once he had heard about this approach, Bill Phillips realized it would be an obvious way to organize his model. Newlyn was now rather excited: might it be possible to extend this to a full model of the economy? Bill’s insights on savings and investment could be taken further to include government and external sectors making up a full macroeconomy.

In May 1949 Newlyn himself drew a diagram to represent a full economy version, incorporating these missing sectors. Returning to Leeds University, he took the diagram to his Head of Department, Professor Arthur Brown, and explained how this might be modelled. In what seems by current standards a remarkably simple process, Arthur Brown immediately agreed that this would be an exciting develop- ment. He provided £100 (about £3,000 today) from Leeds University departmental funds to pay to an unknown student, Mr Phillips, to help cover the cost of building an unproven machine.

Bill set to work with alacrity. During the Easter vacation of 1949, he spent a considerable amount of time converting the diagram into physical plans. Then came the job of construction. He was now boarding with a friendly and long-suffering couple in Croydon. His landlord R. W. Langley, formerly of the Metropolitan Water Board, had a well-equipped workshop in his garage. The Langleys must have taken to Bill, for they were very helpful to him. They agreed to turn out their car for the summer so that Bill could use the garage for his project, and they kept a paternal eye on his progress throughout.

When he later wrote his account, Bill described his task as to build a machine to solve a problem that could be mathematically represented by a system of differential equations. Because the machine was primar- ily intended for demonstration purposes, the whole of the operation should be visible. ‘For this reason hydraulic methods have been used in preference to electronic ones which may have given greater accuracy and flexibility, the machine being made of transparent plastic (“per- spex”) tanks and tubes through which is pumped coloured water’.

The machine consisted of a series of tanks attached to a steel upright frame, all connected by hoses and pipes, each tank representing a sector of the economy: households, business, government, and foreign sec- tors. Each tank had a device (a float or a servo-mechanism) to measure water levels or flows. When these reached certain levels they triggered cords on pulleys that in turn transmitted pressure to other tanks. Other mechanisms represented interest rates and exchange rates. Water was pumped around the whole system. And at the bottom of the contrap- tion a holding tank represented total national income.

There were many clever refinements. The whole system was made up of a series of equations, each one controlling behaviours in the relevant sector. This was achieved by cutting slots in a series of perspex sheets which could be fitted into small frames hung off pulleys, and in the slots, brass pins guided the way each sector could behave.

In resource-scarce post-war London, there was one particularly rich source of building materials, and that was war surplus, especially the lightweight equipment that had been used in the air force, with which Bill was well acquainted. He adapted pumps from aircraft landing gear to pump the water around the system. Willie Brown recalls that one pump came from the reserve tank of a Spitfire. Bill constructed reser- voirs from sheets of the war material called perspex cut from bomber windscreens. He constructed an arm above the machine to carry graphs where pencils outlined the path of the economy; this arm was powered by the mechanism of an old clock (similar to his childhood shooting gallery mechanism). There seemed to be no limit to Bill’s ability to improvise, which should be no surprise for someone who had spent four years surviving a prisoner of war camp.

Doreen Newlyn writes about her husband Walter and Bill together:

the two worked through the summer vacation, fed and cosseted by the friends in whose garage they worked; and by the beginning of the new session when Walter had to return to Leeds, it was complete. They had great fun, exercised much ingenuity in assembling—scrounging, searching rubbish tips, adapting— the parts, some of which came from the factory of a maker of dolls’ eyes.

Bill’s Melbourne sister Olive had a brother-in-law who lived nearby at Reading. Sometimes Bill would take the train there at weekends to have a break from work. Talking to the Reading family he tried to explain what he was building, comparing his machine to a number of tubes of mercury rather like an old-fashioned upright barometer. When pressure went on one tube, the others would react.

Bill did not build the machine alone. His friend and landlord Bob Langley acted as a willing apprentice. And Walter Newlyn spent the summer vacation in London where he says his role was craftsman’s mate, sanding and gluing pieces of perspex. Bill was the engineering chief, but he consulted Newlyn on the economic interpretation: what should a government sector look like, and how to incorporate a budget deficit or surplus? (Answer: a hinged barrier on the link between government and financial markets which opened and closed the water conduit.) How to represent an external sector? How should the exchange rate influence trade, and what were the implications of the Bretton Woods arrangements for incorporating capital controls into the machine?

Some of this construction was intricate work. In an era when plastics were in their infancy and glues unreliable, Bill was trying to assemble sophisticated hydraulic mechanisms that required precision engineer- ing, avoided leakage, and allowed for accurate calibration (involving dials and gradations, aiming for limits on accuracy of 4 per cent). Walter Newlyn commented that his main impressions from working with Bill were his meticulous and patient concern for the best possible outcome, his ingenuity in combining electrical and hydraulic features into the machine, and the outstanding skill he had in engineering complex shapes for complex concepts.

The 1949 summer vacation came and went, with Bill still hard at work on the unfinished machine. Lectures started again, and Bill should have been spending the time attending to his final year soci- ology courses. But it seems that Bill had lost interest in sociology, and the machine had now become his real passion. This undoubtedly detracted from work towards his final exam in his sociology major at the end of the summer term. Newlyn adds that he felt some guilt about this, a guilt that was only assuaged as he watched Bill’s sterling career progress.

Bill seems to have decided by this stage that sociology was a disap- pointment, and it held no intellectual future for him. He was entirely focused on his new interest. He does not seem to have been too surprised or even worried when he received his third class examination pass.

More importantly, at the end of term in 1949 his scholarship also ran out, leaving him with no visible means of support. The model was still unfinished. He described himself as ‘practically living on air’ through this period. But someone who had survived four years in a POW camp was not going to let this stop him. Walter Newlyn guaranteed a small overdraft to allow Bill to purchase materials at this time, and the ever helpful Langleys excused him rent for board and lodging, even buying him a packet of cigarettes once a week. Bill’s sister remembers that, for the only time in his life, Bill wrote home asking for financial support, indicating that he was short £400–£500. She remembers his parents discussing this: they made a big effort and sent him the £250 that they felt they could manage, writing that they were only sorry they could not afford to send more.