This is what endears him to many, including New Zealand software entrepreneur John Blackham who had close encounters with Ma when they both sat on the APEC Business Advisory Council. Blackham was on the council from 2006-2009.

Judging by Ma’s move to list Alibaba.com on Wall Street: “US is still THE market you have to conquer,” Blackham, now based in Minnesota, says.

“However, when Ebay’s then CEO Meg Whitman bought into China, in 2005, she said control of the on-line market would be won or lost in China…and Alibaba has proved her right.”

Alibaba’s market capitalisation, after its shares closed on Friday, is over US$200 billion, larger than ebay and Amazon’s market value combined.

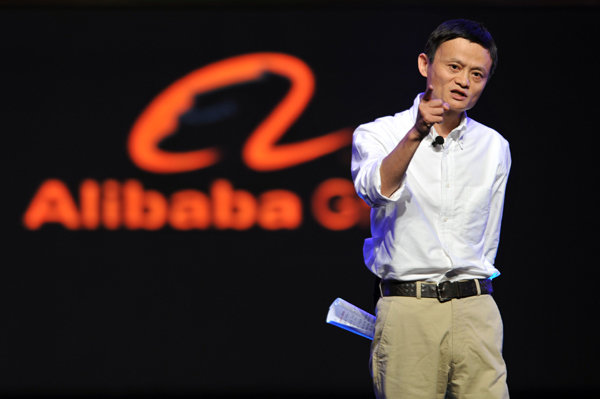

Blackham says he is a great fan of Ma. “Ma is a charismatic figure. It is difficult not to get along with him. As an ex-English teacher, his diction is first class. When he finally became chair of one of the committees, he enjoyed the few two-minutes when he voiced his vision, then it was all down hill as the bureaucratic treacle of officialdom gradually stifled the energy and he stopped turning up to meetings.”

A week in Hangzhou

Blackham says: “We spent a week at his place in Hangzhou. He’d recently bought a former royal palace on the West Lake and turned it into a ‘hang out’. He re-housed all the squatters living there in nice apartments. His heart was always in the right place.”

Ma’s commitment to helping the small guys, saw him hooked up with Nobel Prize Winner Muhammad Yunus of Grameen Bank, Blackham says.

Ma saw the need for micro-loans to get small Chinese business off the ground and he saw them as his new customers. He provided US$5 million in seed money to fund a Grameen Bank in China, to fund farmers and small businesses in Sichuan and Inner Mongolia.

“To me the Alibaba story was not so much the stuff you didn’t hear in the media – the start (selling water buffalos) or the dangerous trip to Hawaii to get his friends money back – but the everyday way he went about building Alibaba.

“No magic formula, just knocking off problems one by one, standing strong when things went wrong and lots of focus and hard work. It’s the same approach I like to take. It’s enduring, as opposed to the US quick buck, fire their arse, greed is ok approach.”

Here are some things you should know about Ma:

– His central business tenet: “Customers first, employees second, and shareholders third.”

– When he started out in 1999, he was rejected by “so many” venture capitalists, he told a Stanford College seminar.

– He is currently China’s richest man, post IPO, but started on a teacher’s salary of US$12-15 after he graduated.

– He failed his college entrance exam twice.

– “Till today, the only thing I can use on my computer is send/receive and browse.” – Jack Ma

– “I don’t want to read the manual, I just want to click, and get it, if not, it is of no use.” – Jack Ma

– One of the books, Jack Ma wants to write is AliBaba 1001 mistakes.

– “When we managed to raise US$5 million thought we were rich, like any startup, when we have money, we made mistakes.”

– Ma used the Alibaba name after he surveyed people on the street in San Francisco, while at a café. The name comes from a character in a Persian classic 1001 Nights – Ali Baba and the Forty Thieves

– “If you have money, but have not turned this money into an experience to elevate your own or other people’s level of happiness, then you may very well only possess a lot of symbols and a mountain of very colorful pieces of paper.”