The seminars were hosted in Wellington, Auckland and Palmerston North by Massey University and discussed contemporary retail trends, as well as the broader implications for businesses and stakeholders.

Speakers at the event included Progressive Enterprises head of online Sally Copland, First Retail managing director Chris Wilkinson and Harvey Norman head of digital and ecommerce Rick Goebel.

A topic of hot discussion was the entry of international retailers into both the physical New Zealand market and the online shopping market.

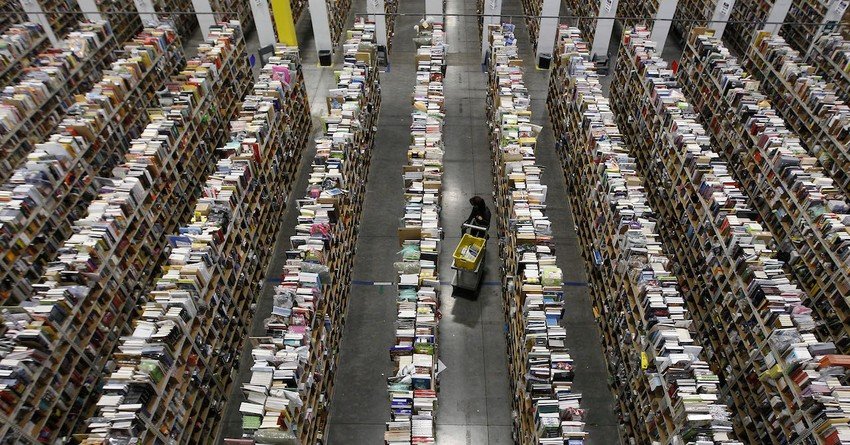

Elms said Amazon’s move to set up a new distribution centre just outside of Sydney will offer Kiwi shoppers even easier access to the online giant’s goods, but he wouldn’t be surprised if it set up a centre here too.

“I think it’s a question of if, not when, as if they’ve done it successfully in Australia, New Zealand will be one of the last viable markets,” he says.

“The issue is around GST and how the Government is going to lose out potentially there. If Amazon does come to New Zealand and I think it will do, it will have even more repercussions than it will do currently and potentially have a ripple effect across the whole retailer industry.”

New Zealand retail industry

- $75 billion in sales in 2015

- Online sales increased 17 percent over the past year, compared to a growth of 3.5 percent in physical stores

- 10 percent of overall retail sales take place online online

- 40 percent of Kiwi shoppers’ purchases are from overseas companies

Elms said new entrants H&M, Zara and David Jones currently don’t offer online shopping in New Zealand yet as they don’t have the infrastructure, but the market will change once they do.

“I think over time it will happen but at the moment they’re trying to establish a good store presence and roll out across the cities. When those retailers go online, they will have a huge impact as whole.”

Other points discussed included the future of bricks and mortar in New Zealand.

Elms said bricks and mortar will continue to be the dominant channel that people shop at, but the composition of physical stores is going to change.

“There’ll be fewer stores and properties and they’ll be convenience orientated in their format. There may be steady decline of big-box retailing, but that all depends on how successful retailers are at maximizing sales space,” he says.

“Convenience will become much more of an increasingly central concern. That’s going to have an impact on the products that are sold and the properties.”

Describing the modern-day consumer

- Renting and leasing products – younger consumers are demanding experiences rather than owning physical products ?

- They want to be part of a community and a bigger picture, as they have concerns about environmental issues and a sustainable future

- Bored of being continuously being bombarded with ads and discounts ?

- Content must be consistent and authentic – wool can’t be pulled over consumers’ eyes. ?

He gave the example of Countdown Ponsonby, which has a product offering specifically tailored around the neighbourhood it’s situated in.

Pop-up stores were also playing into this trend, he said, but the catch with them was the costs associated with them.

“If they’re really well thought through, they’re great in terms of brand recall and awareness, but they can be expensive to put together and transport places,” he says.