The slump our global economy got hit with in 2008 seems to have become a distant memory of the past, as tech startups around the world are blowing past the billion-dollar valuation mark.

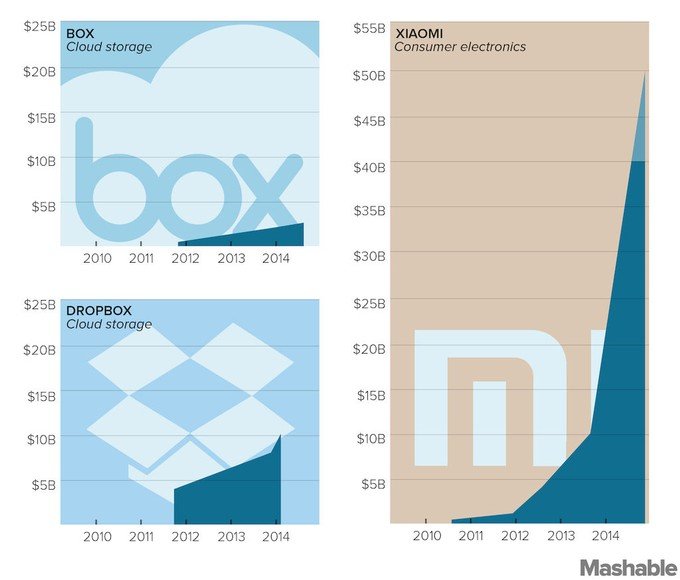

An infographic created by Mashable has revealed the global brands that, over 2014, have managed to achieve 11-figure valuations, including Uber, WhatsApp, AirBnB, and Dropbox. More importantly, the infographic revealed the sharp increase of these companies’ worth from as little as two years ago.

Such figures are arguably harder to replicate in the New Zealand startup scene, but the growth potential is certainly strong, represented by the companies listed in the most recent Deloitte Fast 50, with the top five listings surpassing the 1000% revenue growth mark.

However, the multi-billion dollar valuation numbers are statistics which “are batting out of the park”, says New Zealand Angel Association executive director Suse Reynolds.

“Yes, there is an upward trend [globally],” she says, but it’s something that is very hard to be viewed as realistically quantifiable.

“Over-hyped valuations don’t actually help anybody much. We need to stay realistic about this space. We need to focus on where the value really genuinely is.”

Reynolds says Catherine Mott, CEO of BlueTree Allied Angels, who spoke at the recent association’s angel summit, asked an astute and poignant question: “Is there someone that would really genuinely pay that sort of money for that kind of venture?”

However, such valuations are indicators of not only a recovering economy, but also potentially a booming one. A recent report from the New Zealand Venture Investment Fund (NZVIF) and chief executive Franceska Banga revealed that even though 25% of the portfolio from the $260 million Venture Capital fund – one of two funds run by the NZVIF – has already been written off, the fund is still in the black.

“What we’re seeing is that post-global financial crisis, investor confidence has returned, particularly in the technology sector, and we’ve seen this reflected in the funds we invest in,” Banga says.

It’s a position that Reynolds agrees with. “I think it’s another reflection of the fact that the global financial crisis is just kind of drifting in to the background. It’s fading from people’s memories just a little,” she says.