With chatbots like ChatGPT bringing artificial intelligence (AI) into mainstream use, specialist AI tools are being developed to help investors with their decision-making.

AI-powered chatbot TigerGPT has just been launched for the New Zealand market, offering a ‘virtual investment assistant’ for the growing number of Kiwis trading stocks and other financial products online.

The chatbot was created by Nasdaq-listed global online broking firm Tiger Brokers, which operates the Tiger Trade platform and has offices in Singapore, New York, Beijing, Sydney and Auckland.

One of the first of its kind in the industry, TigerGPT is also available to users in Australia and Singapore. While it does not provide financial advice, it can help investors quickly aggregate available information into one hub of information for review and analysis.

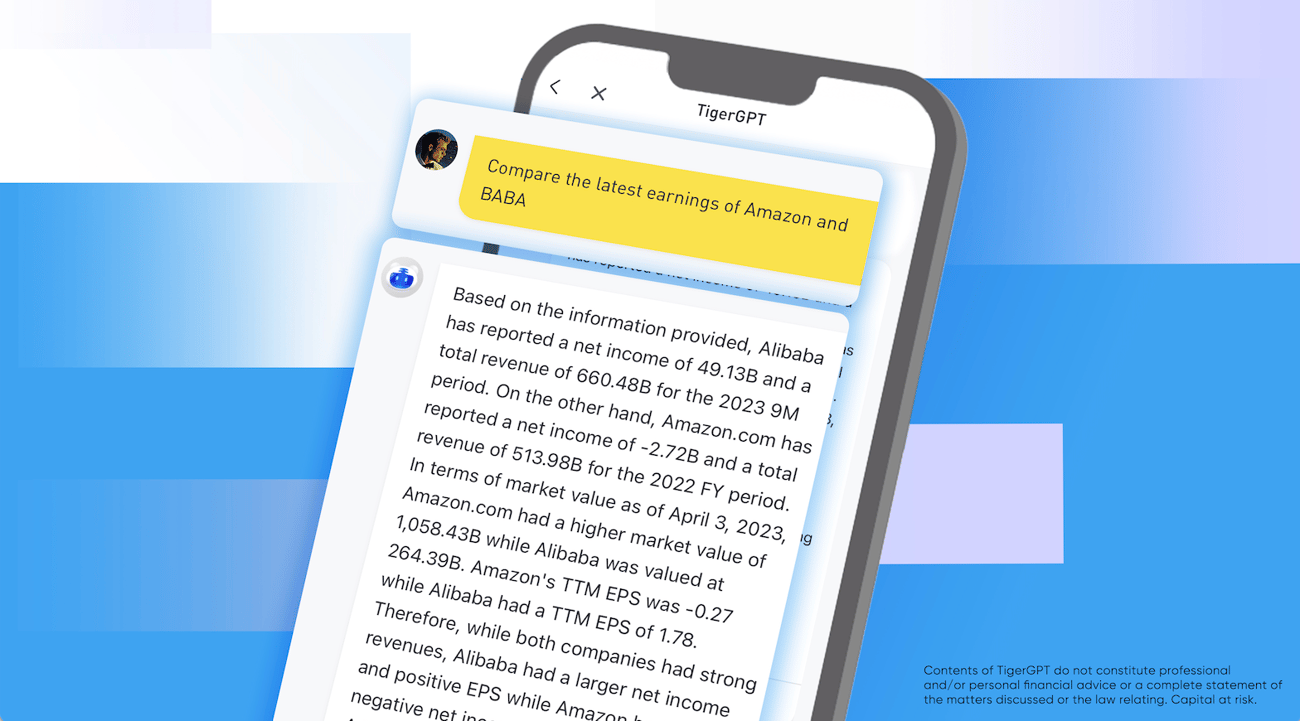

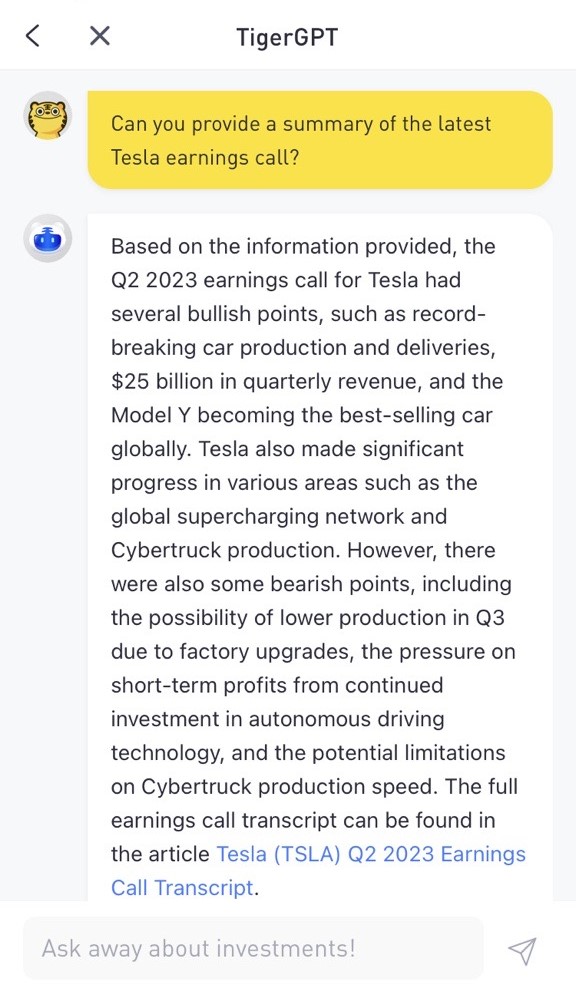

The chatbot introduces innovative features that allow investors to research stocks, summarise key insights from earnings calls and releases, and extract pertinent company news and sentiment analysis based on the nature of the questions asked, all within seconds.

TigerGPT was developed by Tiger Brokers’ research and development services and engineers, and has officially launched to the market after successful beta testing since April.

By accessing the Tiger Trade app, users can engage with TigerGPT by asking questions.

Read more: How can businesses use AI chatbots?

“TigerGPT is a significant advancement in Tiger’s efforts to enhance investors’ journeys so they can make informed investment decisions before trading in the shares of a given company,” Greg Boland of Tiger Brokers New Zealand, says. “We recognise the crucial role AI plays in the investment industry today and its potential for future growth, which is why we developed TigerGPT — to revolutionise the investor experience on a larger scale.

“With TigerGPT as their AI investment companion, Kiwi users can now assimilate and aggregate data to aid in making their own decisions. The functionalities of GPT, AI, and machine learning are gaining popularity and being broadly applied in sectors around the world, and TigerGPT is another iteration of this technology.

TigerGPT has several new features to streamline pre-investment decision-making, including personalised stock research that enables investors to quickly filter stocks based on their own criteria, and show trending market topics to help investors to pinpoint the trends in the market.

Another key feature is the ability to summarise the highlights from earnings calls and releases, offering investors a comprehensive overview of a company’s performance at a glance.

Leveraging Tiger Trade’s access to premium data and research, TigerGPT adds data including support and resistance indicators, stock trend analysis, and economic calendars, expanding its capabilities to address a wider range of inquiries efficiently.

TigerGPT also offers multi-turn conversations, enabling the chatbot to remember previous user inputs and provide meaningful responses based on the ongoing conversation.

It is integrated into Tiger Trade’s app as a chat bot, and appears as a pop-up notification on individual stock pages when unusual stock activities or significant events are detected.

“Users can enjoy a whole new dimension of interactive experience, and we encourage them to use all available data and reporting to make more informed and evidence-based investment decisions,” Boland says. “We continue to invest in enhancing and updating this tool on a weekly basis.”