New Delta Insurance whitepaper takeaways: insure your ideas to stop others from suing you for them

It’s not easy to innovate, as anyone can attest. But what’s not as well-known: not only is it difficult to come up with an idea and make money off it, but it’s even harder to protect that idea from others who might copy it and make even more money off it without coming up with it themselves.

That’s one of the key takeaways from a new whitepaper from Delta Insurance. Released in early November, the whitepaper, titled “Protecting Your Competitive Advantage,” deals with what’s known as intellectual property (IP) risk management. According to the whitepaper, IP counts as an “intangible asset” of a company – something which could be proprietary knowledge, customer data, relationships with other businesses, designs, innovation, and more. Citing statistics from Ocean Tomo that state the value of intangible assets to the average business has increased from 17 percent of total assets in 1975 to almost 87 percent in 2015, it goes on to state that these intangible assets are also important to businesses and organisations in Aotearoa – especially with our famed No. 8 wire mentality and culture of innovation.

“I think the big issue here is that start-ups are spending a huge among of money collectively in NZ (over $1.6 billion R&D spend in New Zealand last reported) and spending a massive amount of time developing innovative new ideas and concepts – all of which are world leading and incredibly exciting,” says Craig Kirk, co-founder and general manager of Delta, of some of the whitepaper’s most important findings.

“However, there is concern that they are not thinking strategically about managing and protecting these intangible assets. For tech start-ups, their value is in their intangible assets and IP. Period. The question, therefore, is how they secure their IP smarts so that they can benefit from the commercialisation of these assets – before someone copies them or beats them to it.”

So how, exactly, can businesses of all sizes – from start-ups to large corporations – secure their IP? Kirk says it can be as simple as buying insurance. But, he adds, even that might not necessarily be enough. “Those that are more proactive will spend considerable dollars registering their IP rights, but even that does not mean you are able to be fully ‘secure,’ as you still need to have the funds to be able to enforce those rights (or in some cases defence and allegations of infringement of rights),” he says. “This is where IP legal expenses insurance can add a lot of value.”

But how do they add value? Kirk explains. “In simple terms, the value of IP legal expenses insurance cover is that it gives you the funds to be able to pay for legal experts to either be able to defend you in the case of someone alleging that you’ve infringed their IP, or to be able to enforce your own IP rights if another party has breached these rights.”

He says more. “The policy also provides affirmative cover in relation to licensee disputes, and in addition provides access to a public relations consultant to assist clients with any reputational issues that may arise as a result of IP litigation.”

Translation: it’s an extra layer of protection to make sure someone doesn’t steal your ideas – or claim that you stole their idea.

All this is especially important because, as the whitepaper states, there is “increased activity” in Aotearoa’s IP landscape. And, the whitepaper adds, not having IP legal expenses insurance can have devastating consequences. As an example, it cites a 2017 case in which a café in Wellington received a notice from Coca-Cola over usage of the word “innocent” in its name – as Coca-Cola owns the trademark. To avoid infringement, the café had to change its name and rebrand.

The whitepaper also uses as an example a 2008 case in which the New Zealand-based electronics manufacturer Phitek was hit with a patent infringement by US-based competitor Bose over Phitek’s noise cancellation technology in its headphones. As part of a settlement agreement, Phitek was forced to make changes in its headphones to avoid infringing on patents held by Bose.

What other trends are we seeing with IP in the Land of the Long White Cloud? Kirk offers some insights. “Unfortunately this data is not collected centrally, so it’s difficult to quote any statistics,” he says of some of the challenges.

“In addition, a lot of legal disputes are resolved out of court and swept under the carpet, because the parties concerned are worried about the reputational issues with a dispute going public.”

Yet he does have some insights. “However, anecdotally, from talking to IP practitioners the trend is that IP disputes are on the increase. This is partly driven by a general increase in litigiousness, but also more active enforcement of IP rights by large, global players who are not afraid to wield their power.”

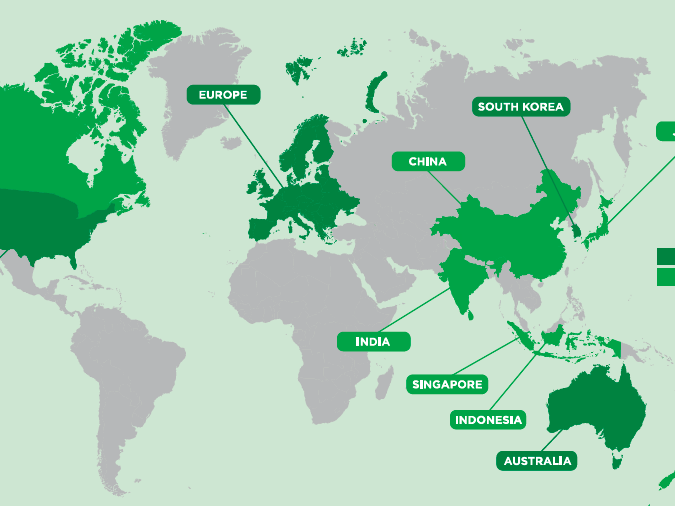

And that’s not all. “There are also major and ongoing challenges associated with the US and China in particular. The message is that if you are taking your offering offshore, you need to be crystal clear that you have all of your ducks in a row.”

With New Zealand R&D expenditure up about 29 percent between 2014 and 2016 – reaching more than $1.6 billion, according to Delta – that seems like appropriately sage advice.

Kirk’s advice is also backed up by Delta’s own findings. As the 24-page whitepaper concludes: “IP risk management, therefore, needs to be a strategic issue for New Zealand business. Overlooking this critical factor can put the company’s Board and management under significant pressure and potentially place the very survival of a business in jeopardy.”

But it doesn’t end on a downer. “Alternatively, effective management of IP ensures that a business can unlock the maximum value from its R&D investment.”

To read more about this visit Delta Insurance.