Cashing out: Prediction market iPredict closing its virtual doors but (maybe) opens a window

This morning, iPredict – one of only three commercially operating prediction markets in the world – has announced that it will begin the process of shutting down.

For the past seven years iPredict has existed under an exemption from the Financial Markets Conduct Act (FMCA), which allowed it to operate with certain restrictions (e.g. participants could only spend $10,000 in their lifetime and predictions couldn’t be traded for sports or entertainment events).

But, iPredict’s application for an exemption to the Anti Money Laundering and Counter Terrorism Financing Act, which requires it to identify every investor and all of their transactions, has been denied by Minister of Justice, Simon Bridges, who has said that iPredict is “a legitimate money laundering risk” despite the low amounts of money traded on the platform.

Unfortunately for New Zealand prediction traders, the cost of complying with the anti money laundering regulations would be too high for iPredict (a nonprofit run by a public university) to continue to operate in its current form.

iPredict will not accept any new deposits, signups or place any new prediction stocks. Existing stocks can still be traded and iPredict will remain operational until all active predictions have come to fruition.

But there is hope yet. VicLink also operates PredictIt, a US-based prediction market which it runs in partnership with US company Aristotle, which provides the US infrastructure. PredictIt operates under what’s called a No Action Letter, which exempts it from US gambling and financial regulations, restricting the amount of money people can invest and the questions that can be asked (mostly politics and a small number of economics questions).

iPredict hopes to start including New Zealand predictions on PredictIt, but this may bring up other regulatory issues under the FMCA, as PredictIt, a foreign entity, will be selling financial instruments into New Zealand.

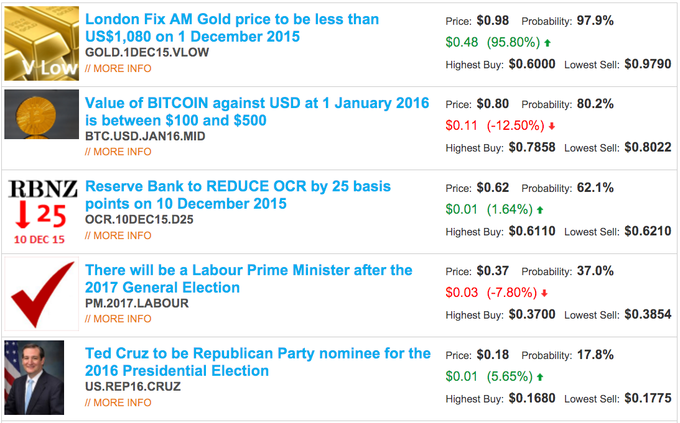

Prediction markets are like stock or commodity markets, where what is being bought and sold is a stake in the outcome. Think Red Peak will become the next New Zealand flag? Well, you could buy stocks in that outcome for (price at time of writing) 6 cents each. If Red Peak is voted in as the next flag of our fair nation, you get a payout of one dollar (minus fees). If Red Peak is not voted in as the next flag, you get nothing. But, if you want to cash out before the referendum, you can sell your shares at any point. If they rise to 8 cents, you might make a tiny amount of money, if they drop to 4 cents, you might lose the equivalent.

Isn’t that just gambling? you may ask. Or, Isn’t that just like a stock market?

Well, no, it’s not, says Todd, “a prediction market is not a financial instrument nor a gambling instrument.”

Sutton says that prediction markets (which are a product of academic research in behavioral economics and market competition) are more like polling, except better, because people are incentivised to be more rational in their predictions than they are when they’re simply asked questions with no consequences.

“It’s much better than any opinion poll because when people place small amounts of money on things, the theory is that they’ll be much more accurate with the stocks and the values they trade because there’s more of an incentive to be honest than all the of the issues that arise when they simply tell someone else what they’ll do,” she says. “So it’s a research tool more so than a financial market.”

“We’ve done experiments where there was no financial incentive, but as soon as you do that, the motivations change and the motivation is to win, not to secure information. And to win, you have to take extreme positions so you end up with information that’s not useful. As soon as you put a small amount of money on it, people behave rationally. And as a collection of people, you get a better prediction than you do than if it was done by a poll. So a collection of people will be rational, even though individuals may still not be.”

“Unlike a poll, where you’re usually asked what you think, in a prediction market, you’re actually saying what you think other people think, or what you believe will happen because you have private information,” adds Todd.

And, according to Todd, that’s the most important function of prediction markets – they incentivise people to make private information public. The potential for ‘insider trading’ – say, for example, Steven Joyce is pretty certain that Judith Collins is about to lose per position in cabinet and so buys stock in that outcome, raising its price and therefore the publically perceived probability of that outcome – is a function of prediction markets, not a bug.

“The whole point is surfacing information. And most of the information is political and we’re doing it without all the fuss of Wikileaks.”

“We’re using the collective opinion of people, some of whom will have private knowledge on an issue, and what we’re doing is surfacing that private information into the public domain,” says Todd. “Insider trading is when you make a lot of money out of effectively cheating. In this case, nobody’s cheating anybody, they’re putting private information into the public domain by predicting the outcome of a public question. The whole point is surfacing information. And most of the information is political and we’re doing it without all the fuss of Wikileaks.”

Todd and Sutton are obviously disappointed to be shutting down iPredict, saying that the small amounts of money involved makes the potential for money laundering minute. People trade in 10s and 20s of shares (which all cost less than a dollar), and are legally limited to $10,000 in their lifetime.

“They’re putting less money at stake as they would at the TAB,” says Todd. “A pokie machine would make more money in a night than we would in two years. Because there’s very limited amount of money at stake, we didn’t think anyone in their right mind would attempt to do money laundering through iPredict because it’d be too expensive for them.”

“The whole point is that this is not a financial, money making thing. It is a prediction thing.”

—

UPDATE: Two members of the public have filed Official Information Act requests with the Ministry of Justice in relation to the decision to refuse iPredict’s application for an exemption from the Anti Money Laundering and Counter Terrorism Financing Act. You can follow their progress here and here. (Hat tip: Eric Crampton)