In an era where AI-powered no-code platforms have made software development nearly costless, venture capitalist McGregor Fea argues that sustainable competitive advantages no longer lie in technology alone, but in businesses’ ability to become deeply embedded within their customer ecosystems.

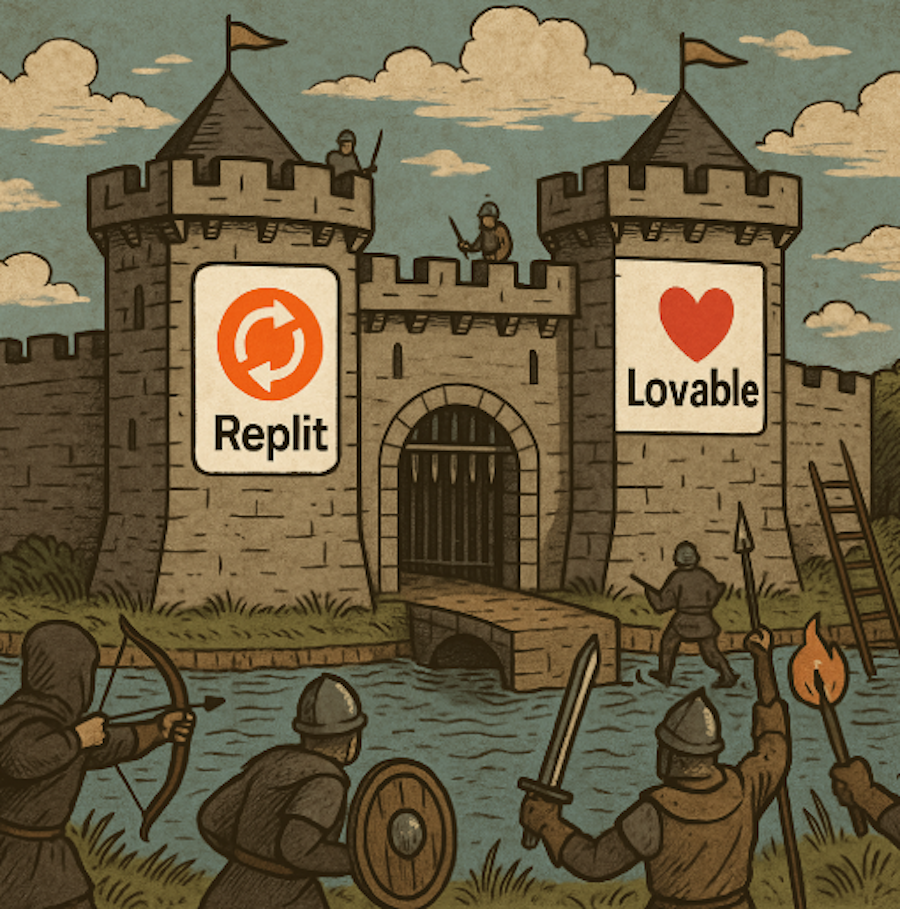

In an era dominated by powerful no-code platforms like Replit and Lovable, it’s tempting to believe that many software companies are doomed. But the reality is far more nuanced. The real, lasting competitive edge – the elusive “moat” every founder chases – lies not in faster or fancier code but in their ability to be entrenched in the ecosystem around their product.

It’s no longer enough for startups to build a better app. With the support of AI, software development is becoming near costless. The businesses most resilient to this change are those that understand their customers’ problems in aggregate and therefore offer solutions that don’t just increase efficiency in one area but become fully embedded in a win-win relationship.

As a case study, marketplace businesses highlight one type of structural protection from low-cost coding. Although software often plays a critical role in the marketplace experience (think Uber, AirBnb and First Table), it is in fact the underlying ecosystem of sellers and buyers (drivers/riders, rooms/guests and restaurants/diners) that makes the business model enduring and difficult to replicate. While anyone can clone a feature overnight, you can’t spin up an engaged community or a trusted brand at the click of a button. In 2025, the strongest moats run far deeper than technology itself.

The marketplace moat

Let’s take a closer look at Roofbuddy, one of our portfolio companies. The company is completely redefining how Kiwis replace their roofs, saving customers thousands of dollars with every transaction. In just three years, it has processed more than 36,000 unique customer enquiries and facilitated over NZ$80 million in roofing transactions across more than 3,700 jobs.

When we first met founder and CEO James Logan and his team, what struck us wasn’t just the company’s technology platform – it was the team’s understanding that a true moat is built on delivering value for an entire ecosystem. Roofers typically convert a small percentage of quotes they create and spend hours per quote on travel, measurement and pricing. Their marketplace lets them quote in minutes and deliver into much higher conversion rates. For the most astute roofers, working with them is a no-brainer, and as a result it has built trusted relationships with more than 100 vetted roofing contractors while simultaneously becoming the only independent brand for homeowners seeking roofing services.

It is true that software is at the heart of the business. In addition to the company’s world-leading geospatial mapping system, the CRM platform connects complex operational workflows that a competitor simply couldn’t copy with off-the-shelf tools. So, although software is the foundation, it is the multiple layers of complexity wrapped into one marketplace, the unequivocal value offered to both buyers and sellers and the added capabilities of vertical integration through their subsidiary businesses Guardian Seal and Guardian Steel that define Roofbuddy’s competitive advantage.

The outcome of this multi-factored moat? Solving the roofing industry’s fundamental inefficiency. Their market presence enables lower prices, higher quality and greater protections for all participants. That’s not just software; that’s a true understanding of industry pain points translated into solutions.

A known Kiwi playbook: build deep, then sell wide

An upcoming phase for this business is to solve the same problems on a global stage. By building a vertically integrated offering and going deep in its home market, Roofbuddy is setting the business up to go wide through international expansion. And, in doing so, is walking in the footsteps of other aspirational Kiwi companies.

A great Kiwi success story grown from going deep in New Zealand and wide internationally is Les Mills. Originally built with world-leading expertise in operating gyms and understanding of the fitness business, the company was able to package up their operational knowledge, including their famous classes, custom weights and online plans, and sell them all over the world. As a result, Les Mills International was born. Today, the gyms are worldwide, but at its foundation is a deep, local understanding.

One of Altered Capital’s larger success stories, Starling Bank in the UK, has followed a similar playbook. Now with over four million users and approaching £1 billion in revenue, it has built an incredibly deep banking model in the UK. Now it’s selling it software and capabilities to some of the largest banks in the world.

In our corner of the world, planning to go global when building start-ups is table stakes. Due to our limited population, consensus thinking is that day one is the time to do so. But often it’s not that simple. Owning a local ecosystem and exporting success in a capital light way can deliver the fastest and highest value way to drive investor returns.

What really matters: the team

When evaluating investments, we look beyond the technology to the mindset of the founding team, seeking out people who combine industry expertise with technological innovation. Complex operational knowledge can’t be replicated by someone who just knows how to code. The founders who succeed aren’t just technologists; they’re industry insiders who’ve identified inefficiencies through lived experience and built technology to solve them.

As a primary method of testing a founder’s belief that they are solving a problem that customers will pay for, we only invest in companies already generating revenue. All founders are passionate about the problem they’re solving. But a founder that understands their market deeply enough to create something people will pay for shouldn’t be taken for granted. You can’t fake product-market fit.

The next wave

As we raise our second $100 million venture fund, we’re doubling down on this philosophy. New Zealand has many unique advantages – including being great at building businesses efficiently, with international expansion in mind from day one. This constraint breeds the kind of innovation that creates lasting value.

So, the next time someone tells you their business moat is their software, dig deeper. Ask what makes them embedded in the lives of their customers. How are they not only saving costs but driving revenue? How established are their network effects? And most importantly, what enables the team to have a wholesale understanding of the problem they’re solving? When code can be generated in seconds, it can be human elements – trust, networks, reliability – that make a solution irreplaceable. With AI shaking up the world of software in real time, the best businesses are built on foundations much deeper than code.